BPI Special Offers, Activities for its 3rd Sustainability Awareness Month this June!

The month of June starts on a positive tone as the Bank of the Philippine Islands (BPI) is gearing up for the 3rd edition of its much-anticipated annual Sustainability Awareness Month (SAM), in alignment with the bank’s sustainability objectives.

In its steadfast commitment to responsible banking and operations, BPI has curated an engaging lineup of activities designed to encourage Filipinos to embrace a more sustainable lifestyle.

With the theme “Beyond Green,” this month-long initiative provides opportunities for the members of the public to adopt sustainable practices and become ambassadors for responsible and sustainable living.

In celebration of BPI’s thrust towards sustainability is the Philippine’s first Corporate Run: #BestLifeRun Corporate Race 2024, scheduled on June 9 at the Ayala Triangle Gardens. The run promotes employee health and wellness while fostering business camaraderie through a fun, healthy activity. More than 120 companies and organizations are ready to participate in this year’s corporate race.

Moreover, on June 13, two enlightening webinars are slated to empower participants with actionable insights. “SustainableME: Power Up your Biz with Renewable Energy” shines a spotlight on BPI Ka-Negosyo Green Financing and Ka-Negosyo SOLARise solutions, catering specifically to small and medium enterprises (SMEs) to enable them to leverage renewable energy solutions for sustainable business operations.

Meanwhile, “Sustainable Investing: Driving Positive Change in the Philippine Stock Market,” conducted in collaboration between BPI Securities and the Philippine Stock Exchange (PSE), will cover the landscape of sustainable investing, emphasizing the pivotal role investors play in supporting and steering capital towards companies committed to environmental, social, and governance (ESG) principles.

On June 18, BPI’s Sustainable Development Finance (SDF) will hold Business Talks conducted by renowned thought leaders who aspire to strengthen the business case for sustainability in manufacturing.

The forum will consist of an economic briefing and discussions on industry-related regulatory updates, including insights on emerging trends in energy efficiency, resource efficiency, as well as sustainable water and pollution control.

While the whole month of June will see daily face-to-face and online educational events related to Sustainability, the 24th will be dedicated to a corporate BPI cash management solution called BizLink. The event titled “BizLink: Maximizing Business Growth and Environmental Impact” will introduce digital solutions tailored for the cash management needs of Philippine companies. New BizLink features include the new Mobile Check Deposit Facility.

On June 26, part of the SAM festivities will be the “Beyond Green: Sustainable Agricultural Technologies and Poultry Practices.” The event will introduce new innovations in the agriculture sector, specifically poultry production and waste management innovations. Vertical Farming and Soil Conditioning will also be launched as the new projects under BPI’s Sustainable Agriculture program which falls under BPI’s 16-year old umbrella program called Sustainable Development Finance (SDF).

SMEs will be the focus on June 27 when SAM features digital cash management solutions for micro, small, and medium entrepreneurs. The event called “BizKo: Sustainable Financial Solutions through Digital Innovation” will introduce BizKo‘s Payment and Collection Facilities for small businesses.

As part of its SAM celebrations, BPI is offering a range of enticing promotions to encourage sustainable consumption. From Real 0% Special Installment Plans (SIP) on energy-efficient appliances and rooftop solar panels to exclusive discounts on eco-friendly transportation options, these offerings underscore BPI’s commitment to making sustainability accessible and rewarding for all.

Eric Luchangco, BPI’s Chief Finance Officer and Chief Sustainability Officer, emphasized the significance of collective action in achieving sustainability goals, stating, “BPI recognizes the power of collaboration in shaping a brighter future for generations to come. Through these initiatives, we aim to inspire meaningful engagement in promoting sustainability across businesses and lifestyles.”

Advancing Sustainability: BPI’s Enduring Commitment

For over 4 decades, BPI has remained steadfast in its adherence to the principles of People, Planet, and Profit. Since formally integrating Environmental, Social, and Governance (ESG) considerations into its operations in 2008, the Bank has been at the forefront of sustainable banking practices introducing numerous “firsts” in Philippine banking.

Beyond conventional ESG frameworks, BPI‘s sustainability blueprint incorporates an additional “E” for Economic Benefits (E₂), reflecting its commitment to driving positive economic outcomes alongside environmental and social progress. This entails facilitating financial wellness for individuals, communities, and businesses from diverse economic backgrounds, as well as channeling investments towards a greener economy and a more resilient society.

In alignment with its sustainability agenda, strategy, and objectives, BPI continues to pursue initiatives aimed at reducing the carbon footprint of its banking operations. This includes exploring innovative branch designs, pursuing green-building certifications, and transitioning to renewable energy sources for its facilities.

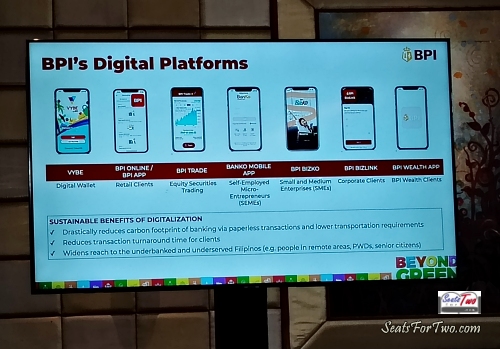

Moreover, the Bank remains dedicated to enhancing its digital platforms to deliver seamless customer experiences. BPI’s 7 digital platforms cover all segments, from large to small companies and micro-enterprises as well as individuals regardless of their location.

- Vybe – digital wallet; online platform providing cashless payments by scanning the QR Ph code of the merchants, adding or sending money to other VYBE users, and receiving money from other local banks and e-wallets.

- BPI Online / BPI App – for retail clients; features: fund transfers, bills payment, BPI’s investment products, track-and-plan with AI-powered insights providing financial advised based on spending and saving habits

- BPI Trade – Digital-based equities trading platform

- BanKo Mobile App – for self-employed micro-entrepreneurs; features: savings, loan payments, load purchase, and bill payments

- BPI BizKo – digital cash management solutions for SMEs, including sole proprietors, freelancers and professionals, partnerships, and start-up businesses

- BPI BizLink – digital cash management solutions for large corporates, multi-national companies, and conglomerates

- BPI Wealth App – for wealth clients; features: investment management

These digital banking solutions underscore BPI’s digitalization journey, empowering Filipinos towards financial security while advancing sustainable and responsible banking practices.

In recognition of its unwavering dedication to sustainability, BPI was honored as the Best Sustainable Bank in the Philippines by Finance Asia for the fourth consecutive year in 2023. Additionally, the Bank clinched the prestigious Biggest ESG Impact award, further solidifying its position as a trailblazer in sustainable banking practices.

Luchangco reiterated the Bank’s commitment to inclusive growth, stating, “Our vision is to foster sustainable and inclusive growth for every Filipino. We remain steadfast in our journey of championing sustainability initiatives, thereby contributing to our mission of building of a better Philippines—one family, one community at a time.”

Furthermore, in 2024, BPI has garnered 10 ESG-focused awards YTD, on track to match the previous year’s 14.

Join the Movement: Get Involved

Know more about BPI’s ‘Beyond Green’ SAM activities and to register for upcoming events, interested participants are encouraged to visit BPI’s official website and access the registration links provided.